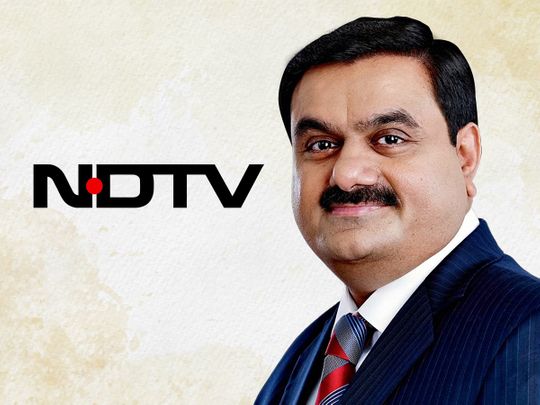

Billionaire Gautam Adani’s conglomerate received the regulatory nod to float an open offer for a further 26 per cent stake in New Delhi Television Ltd, marking a crucial milestone in a takeover battle between Asia’s richest person and the broadcaster’s founders.

The Securities & Exchange Board of India, or SEBI, approved Adani Group’s open offer, according to a statement on the market regulator’s website on Monday, allowing Adani to buy more equity from the media firm’s minority shareholders. The conglomerate revised the offer’s roll out date to November 22. It will close on December 5, NDTV said last week.

Adani’s initial plan was to launch its open offer last month, but was delayed as it awaited SEBI’s approval. The billionaire’s ports-to-power conglomerate triggered a hostile takeover bid for the broadcaster after it acquired an indirect 29.18 per cent stake in August.

NDTV’s founders - Prannoy Roy and Radhika Roy - have opposed the bid, amid concerns that the transaction will erode press freedom in the world’s largest democracy given the powerful tycoon’s perceived close relationship with Prime Minister Narendra Modi.

Adani is now one step closer to gaining a larger footprint in India’s media sector. The billionaire - whose personal fortune valued at almost $138 billion has gained the most globally this year - is rapidly diversifying his empire beyond its cornerstone of coal mining and ports to branch into airports, data centers, cement and digital services.

Adani Group has offered to buy NDTV shares at 294 rupees ($3.6) each, while the media firm’s stock closed 24 per cent higher at 364.85 rupees on Monday in Mumbai.