For the average person, buying a new or used car is the second biggest investment they will make after buying a house. Yet, for many years the process has been viewed as unnecessarily complex.

As the world continues its rapid march into the digital era, the automotive industry also finds itself in the midst of a transformative phase. According to a 2023 report by Roland Berger, 96% of prospective auto buyers in the UAE and Saudi Arabia initiate their purchase journey online, leveraging the internet to research a new car. Interestingly though, only 15% of consumers actually go on to complete the purchase of their car online.

Technology: a catalyst for change

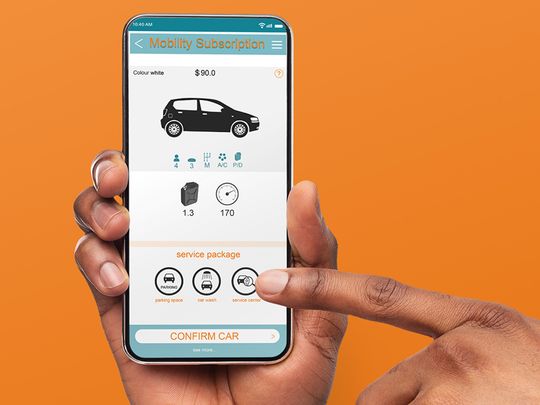

The onus is on the automotive industry to deliver a much smoother process that removes as many of the traditional pain points as possible, placing consumers at the heart of every transaction. Virtual showrooms will complement traditional showrooms but will not replace them, with customers taking a 360-degree view of a car from the comfort of their homes, exploring its interior, and even visualizing how it might look in their driveway.

Analytics will deepen this experience by helping dealerships offer good searchability and personalized car recommendations based on a buyer’s browsing history, preferences, and feedback. By analyzing vast amounts of data, AI can predict which models a customer might be interested in, effectively reducing the decision-making time and ensuring the buyer feels understood and valued.

To many buyers familiar with an in-store salesperson potentially pressuring them into a purchase that might not suit their needs, and often based on limited choice, this is a major step forward.

One other significant pain point for buyers has been the tedious paperwork, along with financing options, insurance, and related negotiations. Digital platforms will allow for online document verification, credit checks, and loan approvals.

The entire purchase process, right down to car delivery, will one day be completed without ever setting foot in a dealership.

This seamless journey will also apply to the ownership experience itself. Smart cars come with integrated technology that allows owners to connect with service centres, receive maintenance alerts, and even book service appointments. Such proactive, tech-driven after-sales service enhances ownership experiences, ensuring that customers feel supported long after the purchase.

The road ahead

Evolving technologies such as gamification for more targeted choice, and chatbots for assistance and feedback will only aid the customer experience, while faster completion times will shorten the online buying journey even further.

While technology provides a myriad of solutions, it is not without challenges. The efficiencies that technological solutions provide must outweigh the cost of building these solutions. Also, producing some advance contents such car hologram is still very costly and niche.

Data privacy concerns, the potential for technology glitches, and the need for continuous updates mean that distributors, wholesalers and manufacturers all need not only introduce innovations but also ensure they keep pace with customer expectations.

Moreover, there remains a consumer segment that values traditional, in-person experiences. Hybrid models, where customers can opt for a combination of online and offline interactions, could prove key to building trust and confidence for this particular customer segment.

A key challenge in the used car market of some regional countries is the lack of quality used car supply. Leases in this region are more typically five-year lease-to-own models, meaning there are less available pre-owned cars of a high standard.

This will not change until there are more shorter-term financing lease options, and it also means there is a lack of integration between dealerships and financing companies.

The local market lacks also detailed car specification information and prices, making purchases difficult without direct, in-person dealership contact. A lack of major used-car dealerships has also resulted in a more fragmented market than other regions.