Dubai: A prolonged period of oil price volatility and the impact of coronavirus (Covid-19) on the regional economies will impact the solvency, liquidity profitability of banks operating in the GCC countries, according to leading credit rating agencies.

The collapse of output cut agreement between Organization of the Petroleum Exporting Countries (OPEC) and Russia earlier this month saw a sudden and drastic decline in oil prices.

On 9 March, oil prices dropped more than 25 per cent from their previous close to trade just above $31 per barrel. The level was 20 per cent below the $45-$52 range in which oil traded the previous week and more than 40 per cent below the 2019 average price of $64 per barrel. The immediate trigger for the sharp retreat of oil prices was Saudi Arabia’s decision to increases the production following Opec failed to reach an agreement on output control to address falling demand caused by the coronavirus outbreak.

Growth impact

“Oil prices, public spending and the credit quality of GCC banks are significantly interlinked and all six GCC countries depend heavily on oil and gas revenues,” said Nitish Bhojnagarwala, vice president and senior credit officer at Moody’s.

Oil prices, public spending and the credit quality of GCC banks are significantly interlinked and all six GCC countries depend heavily on oil and gas revenues.

Public spending derived from oil revenue is a key driver of a high proportion of economic activity in the region, with hydrocarbons contributing between 13 per cent of GDP of Bahrain and 41 per cent of Kuwait.

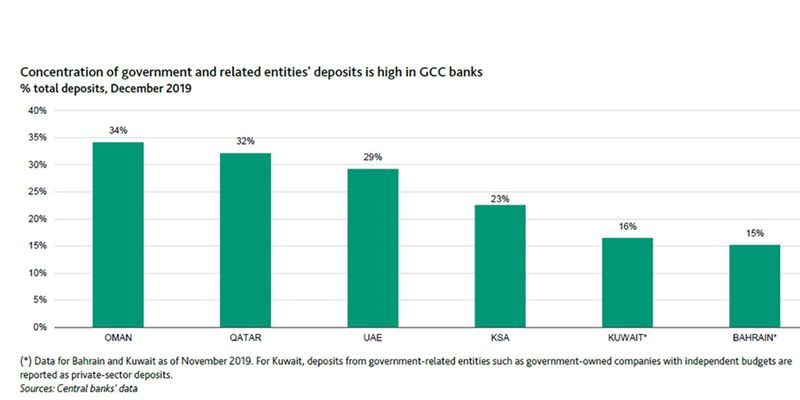

The immediate effect of a sustained period of lower oil prices would be on the liability side, particularly reduced deposit inflows from government and government-related entities. “We estimate that government deposits range between 15 per cent and 34 per cent of the deposits of the GCC banking systems,” said Bhojnagarwala.

The knock-on effects of lower economic growth and oil prices will further slow lending growth and increase the overall stock of problem assets at GCC banks.

Rating agency Standard & Poor’s (S&P) said combination of factors such as lower oil prices, economic impact of coronavirus on regional economies and a deterioration in asset quality could weaken bank profitability in the region.

“The knock-on effects of lower economic growth and oil prices will further slow lending growth and increase the overall stock of problem assets at GCC banks. As a result, we anticipate that cost of risk will edge up. At the same time, interest margins will decline because the US Federal Reserve Board and other local central banks have cut interest rates. Combined, these shifts will weaken banks’ profitability,” said Mohamed Damak, Director of Research at S&P.

Asset quality

Analysts see lower oil-related revenues across governments and related entities would likely reduce asset growth and quality.

“A prolonged period of low oil prices risks constraining existing public spending plans which will undermine confidence and pressure economic growth. Economic growth and consequently credit growth in the GCC has already slowed since oil prices began to moderate in 2014. A more protracted period of lower prices will strain asset quality,” said Ashraf Madani, senior vice president and analyst at Moody’s.

While GCC banks mostly have robust capital and liquidity buffers, all the region’s banking systems credit quality exhibit vulnerabilities that are broadly in line with the relative creditworthiness of their sovereigns. Banks in Bahrain and Oman are the most vulnerable in this respect.

Moody’s expect Bahraini banks to face challenges on growth, profitability and potential asset-quality and liquidity fronts. Omani banks too are expected to experience further strain on their asset quality and profitability, exacerbating difficulties stemming from extended payment cycles.

Analysts said banks in Saudi Arabia and the UAE are facing some existing pressures, but are likely to be moderately affected specifically as a result of the decline in oil prices because of the countries’ relatively large reserve buffers. Both governments can in principle sustain public spending to support economic growth, but low oil prices are likely to constrain governments existing spending plans especially in Saudi Arabia, weakening operating conditions.

“We expect credit growth to remain subdued, while profitability will decline and asset-quality is expected to weaken for the banks in these systems,” said Bhojnagarwala.

“Any loans shown forbearance of this sort will likely be classified as stage 2 loans in the IFRS 9 [International Financial Reporting Standards] classification of loan impairments,” said Mohamed Damak, Director of Research at S&P.

S&P expects capitalisation is unlikely to be affected by these changes and it should continue to support bank ratings.