Dubai: Central banks in the Gulf late Tuesday cut key interest rates following the 50 basis points (0.5 per cent) rate cut by the US Federal Reserve as an emergency monetary policy response to the coronavirus impact on growth.

The US central bank has not made a cut like this since late 2008, shortly after the Lehman Brothers collapse. Fed leaders believed it was wise to move quickly as concerns mount about the plunging stock market and a severe disruption in every major economy. Recession fears in the US had also spiked.

The Central Bank of UAE (CBUAE), Saudi Arabian Monetary Authority (SAMA) and the Central Bank of Bahrain (CBB) have already announced rate cuts following the lead from the Fed. Gulf countries with the exception Kuwait have their currencies pegged to the dollar while the Kuwaiti dinar’s exchange rate is linked a basket of currencies in which the US dollar has more than an 80 per cent weightage.

In normal circumstances, Gulf central banks’ interest rate policies are guided by Fed rates to maintain currency and exchange rate stability.

Urgent support

Analysts say the coronavirus outbreak and its impact on oil exporting GCC countries had warranted policy support to limit the economic and financial fallout.

“In light of global developments, the Saudi Arabian Monetary Authority (SAMA) has decided to cut the repo (rate at which the central bank lend to banks) rate by 50 basis points from 2.25 per cent to 1.75 per cent and the reverse repo (rate is the rate at which the central bank of a country borrows money from commercial banks) rate by 50 basis points from 1.75 per cent to 1.25 per cent,” SAMA said in a statement.

The Central Bank of the UAE said will lower interest rates applied to the issuance of its Certificates of Deposits (reverse repo) as of Wednesday in line with the decrease in interest rate on the US dollar. The repo rate applicable to borrowing short-term liquidity from CBUAE against Certificates of Deposits has also decreased by 50 basis points.

The Central Bank of Bahrain (CBB) decided cut its key policy interest rate. CBB’s key policy interest rate on the one-week deposit facility is cut from 2.25 per cent to 1.75 per cent.

In addition, the central bank also reduced the bench mark money market rate. “The CBB has also decided to cut the overnight deposit rate from 2 per cent to 1.5 per cent and adjust the one-month deposit rate from 2.45 per cent to 2.20 per cent,” CBB said in a statement.

Extraordinary circumstances

The coronavirus outbreak has spooked the Middle East and North Africa economies, especially oil exporting GCC economies, adversely impacting investor sentiment in various sectors of the economy.

Considering the speed and magnitude of the virus spread, analysts say the epidemic will have serious consequences for the world economy and regional economies, resulting in downward revision of economic growth.

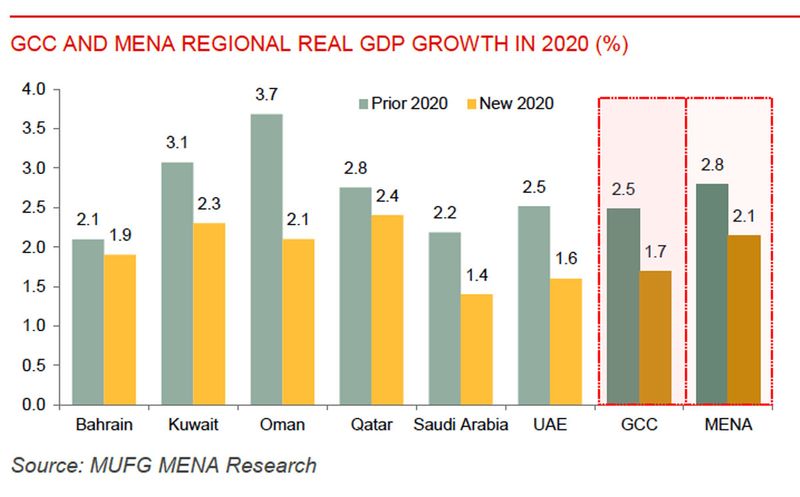

“Our [econometric] models now point to Mena regional real GDP growth of 2.1 per cent in 2020 from 2.8 per cent previously and for the GCC, our models signal real GDP to register 1.7 per cent this year from 2.5 per cent previously,” said Ehsan Khoman, Head of Research and Strategy at MUFG Bank in a recent note.

The latest data suggest virus has cast its dark shadow over the Middle East, as it does globally, and the impact on regional economies are far greater than original estimates. Worldwide, at least 86,000 people have now been infected, with close to 3,000 deaths.

The virus continued to spread in the region with Iran on Saturday reporting maximum number of deaths and new infections close to 1,000. The reported GCC tally of infections has crossed 70.

Economic impact

The key transmission channels for economic impact comes through oil prices, oil demand, supply chain disruptions that have affected trade and impact on travel, tourism, aviation and hospitality industries. IATA recently warned regional airlines are expected to lose $100 million due to coronavirus outbreak.

While the latest round of rate cuts will come as a big relief for borrowers to access money cheap, the central bank has already instructed banks to take a more accommodative stance on lending and repayment schedules considering the extraordinary circumstances.

It asked banks to reschedule loans and reduce fees and commissions as part of measures to mitigate the economic effects of the coronavirus outbreak. The UAE is a regional business hub and major transit point for passengers travelling to China and other destinations in Asia.

“Financial institutions are expected to implement measures such as re-scheduling of loans contracts, granting temporary deferrals on monthly loan payments, and reducing fees and commissions for affected customers,” the central bank said in a statement.

Economies of the UAE and other GCC countries are adversely impacted by the recent outbreak coronavirus in China, according to Standard & Poor’s.