Dubai: Non-oil private sector economy in Dubai remained stable in February with the Dubai Economy Tracker Index unchanged at 55.8, according to the latest data from IHS Markit and Emirates NBD.

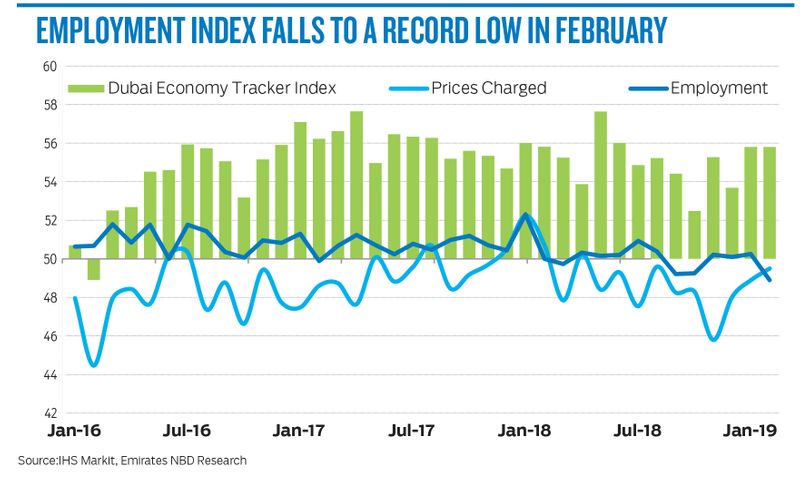

Total business activity rose at the fastest rate in nine months, while new business increased at a pace that remained above the 2018 average despite easing since January. Employment, however, fell at the fastest rate since the survey began in 2010.

“The growth in the volume of output and new work has been underpinned by continued price discounting, particularly in the wholesale & retail trade sector.

Firms’ margins continue to be squeezed as selling prices have declined on average for the last 10 months, while input costs have increased over the same period,” said Khatija Haque, Head of MENA Research at Emirates NBD.

Output prices declined for the tenth consecutive month in February, with the deepest discounting evident in the wholesale & retail trade sector.

Employment declined in February after three months of almost no change, as 5 per cent of firms reported lower headcount last month, compared with 1.8 per cent of firms reporting new hires. The employment index fell to the lowest level since the series began in 2010.

The PMI survey data points to real gross domestic product (GDP) growth in Dubai’s economy, but this growth in the volume of goods and services produced appears to be coming at a cost of lower profitability for firms.

“The lack of job growth in Dubai over the last couple of years has weighed on private consumption, and likely contributed to the increased pressure on firms to cut prices in order to boost their sales and new work, which in turn has eroded margins and reduced firms’ willingness to hire more staff, perpetuating a negative cycle,” said Haque.

The wholesale and retail sector index rose to 58.1 in February, as both output and new orders rose at the fastest rate since June 2018. However, this growth was on the back of further price discounting, as the selling price index declined to 46.3 from 47 in January, even as input costs increased at a faster rate.

The travel and tourism sector index signalled the fastest growth in the sector since May 2018, as both output and new work increased at a sharper rate in February with a modest increase in prices. However, employment in the sector fell the most on record, with 6 per cent of firms surveyed reporting lower headcount in February, compared with January.

The construction sector index was marginally higher at 54 in February (53.8 in January) but momentum in the sector has slowed since 2018. The average construction sector index in the first two months of this year was 53.9, well below the average of 55.6 for the third and fourth quarter of 2018. Output continues to rise at a sharp pace, as expo related projects are scheduled for completion this year, but the rise in new work has slowed markedly since last year. Employment in the sector rose only marginally in February, with this index slipping to 50.7 from 51.4 in January.