Dubai: The UAE’s consolidated government spending for 2019 is significantly higher than last year and is expected to support economic growth of the country in 2019 despite a projected decline in oil revenues.

Although growth in government spending at individual emirates levels vary, analysts said the consolidated government spending is much higher this year and, as such, will have a positive impact on the growth outlook.

“We expect a pickup in expenditure growth in Abu Dhabi linked to the support package [of Dh50 billion over the next three years in various measures], though we will remain cautious on the pace of any increase until we have greater visibility on the degree of direct fiscal stimulus to be implemented,” said Monica Malik, Chief Economist of Abu Dhabi Commercial Bank (ADCB).

At the federal level, the 2019 budget has the planned spending growth accelerating to 17.3 per cent in 2019 (from 5.5 per cent planned growth for 2018) while the emirate of Sharjah announced an expansionary budget with government spending set to rise by 10 per cent from the 2018 budget.

Dubai expects to slow the growth of state spending this year but continue spending heavily on infrastructure as it prepares to host the Expo 2020. Total expenditure growth is set to moderate sharply in 2019 to just 0.4 per cent from the strongly expansionary fiscal stance in 2018, which saw robust planned spending growth of 19.6 per cent.

17.3 %

acceleration in the UAE’s planned spending in 2019, up from 2018’s planned growth of 5.5%Economists believe that the Dubai government’s willingness to maintain the elevated level of spending in 2018 and to commit itself to the largest ever annual spending plan of Dh56.8 billion ($15.5 billion) is positive for the non-oil growth outlook of the emirate.

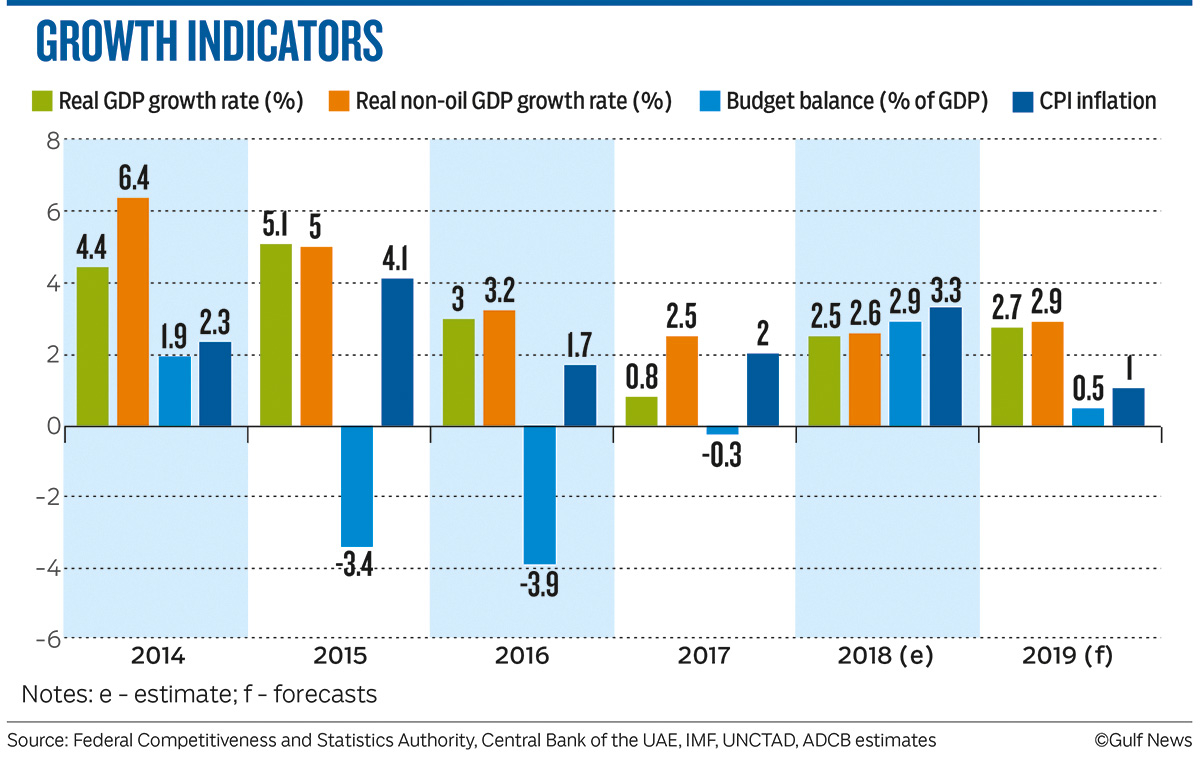

Although many economists have reduced their growth forecasts for the UAE in the wake of falling oil prices and a decline in crude output, as a result of the decision by the Organisation of Petroleum Exporting Countries (Opec) to lower output by 800,000 barrels a day from what the group pumped last October, the forecasts suggest the country will maintain higher growth compared to 2018.

We see real non-oil GDP growth rising only modestly in 2019 and remaining well below the pre-2016 trend.

In compliance with Opec’s quota, the UAE is expected to cut production this month by about 2.5 per cent from what it pumped in October. Analysts said the oil output should still be higher than the 2018 annual average, given the lower oil output in the first half of 2018. Thus, the oil sector should still see positive real growth in 2019.

In addition, the government-led investments and an acceleration in hydrocarbon projects in Abu Dhabi is expected to boost oil sector growth. However, the impact of oil sector investments on the non-oil sector growth is expected to remain modest.

“The multiplier support from hydrocarbon projects to the wider economy tends to be more muted than other areas of investment. We believe that certain areas of growth support will be more statistical rather than reflecting a meaningful improvement in underlying condition in 2019. As such, we remain cautious about the pace of any non-oil recovery,” said Thirumalai Nagesh, an economist at ADCB.

Challenges ahead

While higher consolidated government spending will remain a major catalyst of economic growth in the UAE this year, the economy is expected to face a number of challenges ranging from tighter monetary policy, slow job creation, lower oil revenue and the ongoing real estate correction.

Lower oil revenues are likely to have an indirect adverse impact on non-oil sectors.

The UAE’s Purchasing Managers Index (PMI) data for 11 months indicate non-oil private sector growth is under pressure. The average PMI up to the end of November was 55.7, marginally lower than the average of 55.9 recorded in the same period last year, signalling growth in the non-oil private sector at a similar rate to 2017. Official data showed the UAE’s non-oil sector grew 2.5 per cent in 2017.

“We see real non-oil GDP growth rising only modestly in 2019 and remaining well below the pre-2016 trend,” said Malik.