Highlights

- Before investing in an IPO, it’s important to have a thorough research of the company.

- A good starting point is the company's “prospectus” — detailed information about the company and the IPO, including the expected price range of the shares.

- To determine if the IPO is right for you, it is important to carefully consider the risks and potential rewards

(Editor's note: This is for informational purposes only, not a stock market advice. It is advised to consult a licensed broker or registered financial advisor when investing).

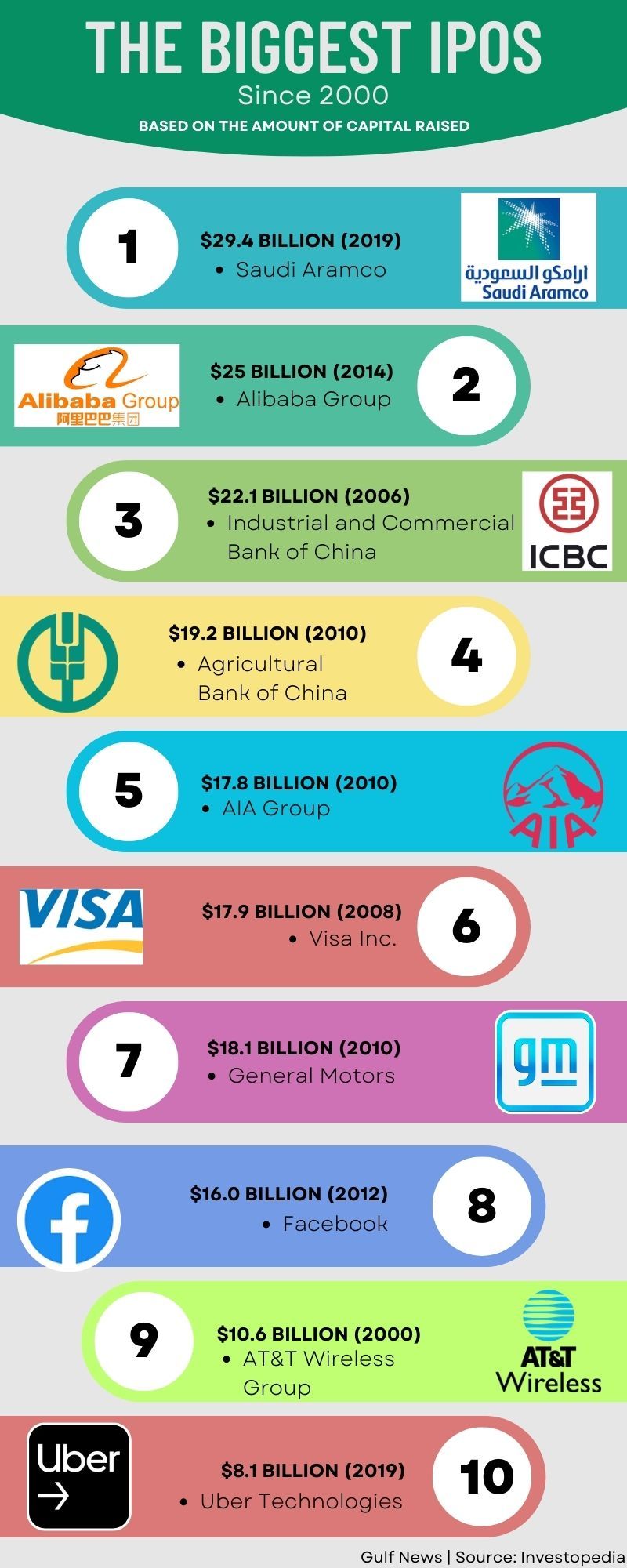

Initial Public Offerings (IPOs) generate much excitement. For one, it offers the opportunity to invest in a company that's about to go public.

An IPO is often the first time members of the public have the chance to invest in a company. This is particularly exciting for people interested in investing in innovative companies and getting into the market.

IPOs have symbolic significance, too: they represent a milestone for the company and its founders, an indication the company has attained a certain level of maturity.

What is an IPO?

An IPO, or initial public offering, is the process by which a company offers its shares of stock to the public — for the first time (ergo, “initial”). As a rule, a company applying to go public is required to submit an "IPO prospectus" as part of disclosure to regulators.

An IPO has certain benefits. For on, it provides the opportunity for the company to raise funds by offering shares to the public, which can then be used to expand the business. It can be a crucial step in achieving its growth objectives. The demand (or "subscription") for the company's shares and their subsequent performance on the stock market are often used as yardsticks of success of an IPO.

What is the IPO process?

In general, in order to go public, the company must file registration statements with market regulators, and meet certain disclosure requirements, such as providing detailed financial and operational information to potential investors.

After the registration is approved, the company sets an IPO price range and starts selling shares to institutional and individual investors.

Once the IPO is completed, the company's shares become publicly traded — they can be bought and sold on a stock exchange.

The prospectus providEs valuable insights into the company's business and financial health. This helps investors make an informed decision about whether to invest in the company's stock.

What are the potential IPO upsides?

Potential for large returns: IPOs are often associated with the potential for large returns. If a company performs well after its IPO, the value of its shares can increase significantly, leading to significant profits for early investors.

Media coverage: IPOs often receive significant media coverage, which can create a sense of hype and excitement around the company and its products or services. This media attention can also help to raise the company's profile and increase interest in its shares.

What are some potential downsides?

For companies going public, IPO costs can be high, with significant fees to be paid to underwriters, accountants, lawyers, and other professionals to prepare and execute the IPO. Before a company is allowed to go public, there are transparency requirements on financial performance, operations and plans.

For investors, IPOs are often priced at a premium to the company's actual value, making it difficult for retail investors to achieve significant returns unless the company's stock price increases substantially.

There’s also usually a “lock-up period” for founders and insiders of the company, during which they cannot sell their shares. This can create an oversupply of shares once the lock-up period expires and can lead to price drops.

If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes.

So while investing in IPOs can be exciting and potentially lucrative, it is important to carefully consider the potential risks before making an investment.

How can I invest in an IPO?

Investing in an IPO can be a bit more complex than buying an already publicly traded stock. For an average investor, it’s often difficult to acquire shares in a company about to go public.

The reason: Brokers usually save their IPO allocations for favored clients, so, unless you are a big fund (or "institutional investor"), chances are you won't be able to get in.

In general, these are the key steps:

• Research the company: Read the company's prospectus, which is a document that provides detailed information about the company and the IPO, including the expected price range of the shares.

• Determine if the IPO is right for you: Consider the risks and potential rewards of investing in the IPO, and decide if it fits your investment goals and risk tolerance.

• Find a brokerage firm that offers IPO access: You may need to meet certain eligibility requirements, such as having a certain account balance or number of trades.

• Place an order: IPO shares are usually allocated to “institutional investors” first. Individual investors may not receive the full amount of shares they requested or may not receive any shares at all. If you are eligible to invest, you can place an order for the IPO shares through your brokerage firm.

• Wait for the stock to start trading: After the IPO, the stock will start trading on a stock exchange, and you can buy or sell shares like any other publicly traded stock.

Note: The stock price can be volatile in the first few months after the IPO. It's always recommended to do your own research and consult with a financial advisor before investing in an IPO.

Should people hurry to get into a stock right away?

There are contrasting opinions on this.

Kathy Donnelly, co-author of The Lifecycle Trade: How to Win at Trading IPOs and Super Growth Stocks, studied 1,679 stocks from 1982 to 2017. The book provides guidance on how to develop a disciplined trading plan and execute trades effectively.

The authors then laid out case studies and examples of successful IPO trades, as well as practical advice on how to manage risk and maximise returns.

They found out that 55 per cent of IPOs "undercut" their Day 1 lows in just three weeks.

“And even more than that, 91% of all stocks will undercut their Day 1 low. So there’s really no hurry to get into the stock right away,” she told Yahoo Finance in an interview.

Investing guru and Berkshire Hathaway chairman Warren Buffett offers another important advice. One of the most important Buffett quotes on investing that you can take in is: “If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes.”