Highlights

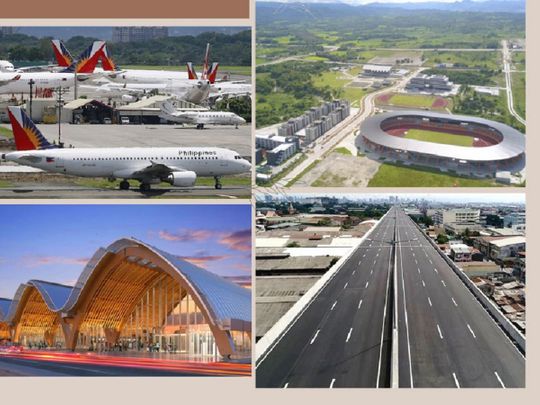

- Two new laws seen as "game changers", and will boost country’s attractiveness to foreign direct investments (FDI).

- The first law, which kicked in January 21, 2022, opens retail industry to 100% foreign ownership.

- The second, now awaiting President Duterte’s signature, is set to open telecoms, rail and subways, domestic shipping, airlines, expressways and tollways, airports to 100% foreign ownership.

- It changes 86 years of definition of what constitutes “public utilities” in the Philippine legal system.

Manila: A twin set of new laws dubbed as "game changers" could unleash the flow of investment dollars to the Philippines, a market of 110 million inhabitants with a $1.47 trillion GDP, the 18th in the world.

The development is already sparking excitement in local stocks.

Together, the two new laws have one aim: Give Filipinos the right tools to compete in the regional game of grabbing billions of dollars worth of foreign capital that have so far skipped the country.

How? By allowing the entry of 100% foreign ownership in key sectors, thus shedding off more than eight decades of protectionist legislation. The first law — which already kicked in from January 21, 2022 — opens the retail trade to 100% foreign ownership.

The second, now approved by both chambers of the Philippine Congress and awaiting President Rodrigo Duterte’s signature — will open other key sectors from airlines to telecommunications to 100% foreign ownership.

Here’s what we know so far:

Why are they called 'landmark legislations' or 'game-changers'?

The landmark legislations come 35 years after the ratification of the 1987 Constitution, which prescribes a 40% cap in foreign ownership of key industries.

It also unshackles the economy from a 1936-era law that strictly defines what “public utility” means.

This has resulted the Philippines being a constant laggard in attracting foreign direct investments (FDI) compared to its more enterprising neighbours in the Asean.

What are the 2 changes in investment-related Philippine laws:

The first one: RA 11595 —“An Act amending Republic Act No. 8762 or the Retail Trade Liberalization Act of 2000 (RTLA) — is now a law. It was approved December 10, 2021, and took effect on January 21, 2022.

The second one is an amendment to the Philippine Public Service Act (PSA) — which now allows for 100% foreign ownership of telecoms, airlines, railways in the Philippines. It's been was passed by both Houses of Congress, and is a signature away from becoming a law.

What’s the new retail investment law?

On December 10, 2021, President Rodrigo Duterte signed into law Republic Act No. 11595 (“RA 11595”), otherwise known as “An Act amending Republic Act No. 8762 or the Retail Trade Liberalization Act of 2000 (RTLA).”

There are important provisions of the new retail law (RA 11595). It provides for the following:

- (a) Lower paid-up capital requirement for foreign retail enterprises “and other purposes”.

- (b) Removal of the requirement for a “Certificate of Pre-qualification” prescribed under the old regime (under RA 8762 or Retail Trade Liberalization Act of 2000). In the past, foreign retailers are required to submit to the Philippine Board of Investments (BOI) this certificate before they can invest in or engage in a retail trade business in the country. This has been scrapped.

- (c) A single minimum paid-up capital requirement of Php25 million ($485,090) for all foreign-owned retail trade enterprises.

- (d) Lower minimum investment requirement per store to Php10 million ($194,036).

When did it take effect? How will it affect 'mega-retailers'?

RA 11595 was published in the Official Gazette on January 6, 2022. It took effect on January 21, 2022 — or 15 days after its publication. In practice, the act would allow greater foreign ownership for some listed companies.

The new rules would also intensify competition in the country's retail indsutry and could pave the way for "mega-retailers" such as Carrefour, Walmart and Target as well as hybrid (digital/physical) retailers to set up shop in the country.

What are the key changes in the amended Philippine Service Act (PSA)?

On Thursday (February 3, 2022), the bicameral conference committee of the two houses of Philippine Congress approved major amendments to the PSA. In essence, the amendments would now allow 100% foreign ownership in telecommunications, airlines and railways, among others.

Initially, there were two versions of the bill — one each from the Senate (Bill No. 2094) and the House of Representatives (Bill No. 78). Under the reconciled version of the PSA amendments, the coverage of “public utility” under Philippine law will be changed to exempt the following sectors:

- Telecommunications

- Domestic shipping

- Railways and subways,

- Expressways and tollways,

- Airlines

- Airports

What happens next?

President Duterte has certified the measure “urgent”, and it will now be sent to the presidential palace (“Malacañang”) for his signature. Once approved, the law would open these key sectors to much-needed foreign direct investment (FDI) and competition.

For example, it is hoped this would translate to:

- Cheaper airfares

- Lower transportation and shipping costs

- Faster, more affordable Internet services across the 7,640-island archipelago

- More infrastructure investments.

Competition for FDI is intense among the Asean neighbours, with the Philippine being a constant laggard. The country is seen as less attractive on account of ownership limits, poor infrastructure and relatively higher cost-of-doing-business measures, Oxford Economics stated in an October 2021 report.

In 2021, for example, Vietnam (which has allowed 100% ownership in key industries) received $19.74 billion in foreign direct investment (FDI), while Thailand attracted $19.5 billion in 2021.

The Philippines, on the other hand, attracted only $7.2 billion (from January to October 2021, the latest for which data is available), according to CEIC country report.

Marikina City Rep. Stella Luz A. Quimbo said while the final the proposed PSA amendment opens up the economy to more foreign investors, it offers protection to small businesses like jeepney operators, and ensures national security safeguards.

Senator Grace Poe, said that in opening these industries adequate safeguards are in place to protect national security and sovereignty.

What is the initial reaction so far?

There’s an air of optimism: Together, the new laws are expected will usher in a "new economic era" for the Philippines.

On Friday, the Phisix (the Index of the two linked exchanges in Manila — Makati and Ortigas) closed near its pre-pandemic high, as the act would allow greater foreign ownership for some listed companies.

Meanwhile, the members of the Joint Foreign Chambers (JFC) applauded the ratification by Congress of the Bicameral Conference Committee report reconciling provisions of Senate Bill 2094 and House Bill 78, expressed optimism the bill will be signed into law.

Despite the Constitutional limits on the foreigners' ownership, the country already draws substantial investments in electronics manufacturing, having recorded $46 billion worth ofelectronics exports in 2021. It also has a growing business process outsourcing (BPO) industry, with its English-speaking young people serving a global clientelle, and ploughing home revenues worth about $30 billion a year.

Millions of overseas Filipinos also sent home about $32 billion last year, hard cash dubbed by the World Bank as "better than loans".