Highlights

- 250 shipping containers of cereal grain worth over Dh15 million stolen in audacious trading fraud

- Scam leaves scores of Indian exporters devastated and baffled at the same time

- 23 TTs worth $4.13 million cancelled after cheques issued against them bounce

- Conman who projected himself as multi-millionaire business owner disappears without a trace

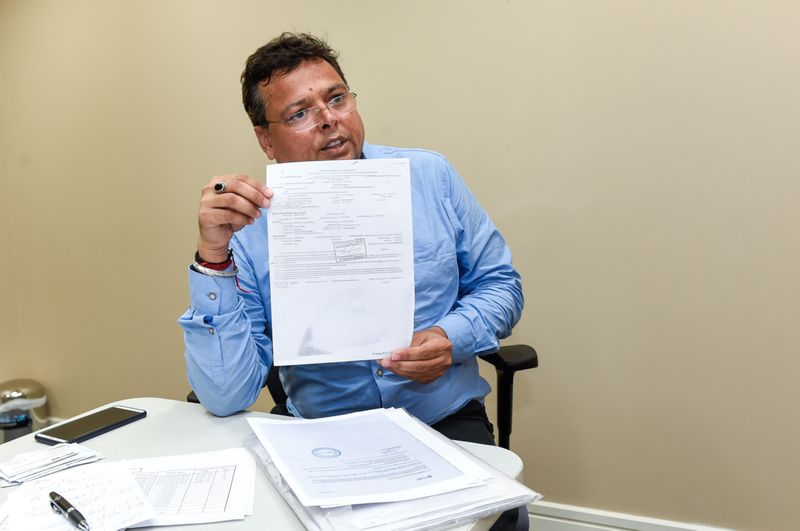

Dubai: For the past few weeks, several rice exporters from India have been camping in Dubai, trying to get to the bottom of an audacious Dh15.38 million scam that has left them baffled and devastated at the same time.

So far the traders haven’t had any luck. Understandably, their patience is beginning to wear thin.

“What is at stake here are not some small packets but nearly 250 rice shipping containers measuring 20 X 8 feet each. Put end to end they could occupy a football field,” says an exasperated Vipin Goel, managing director of Kamla Rice and General Mills in Karnal, a city located in the north Indian state of Haryana.

“So many shipping containers can’t disappear from a warehouse just like that,” Goel reasons.

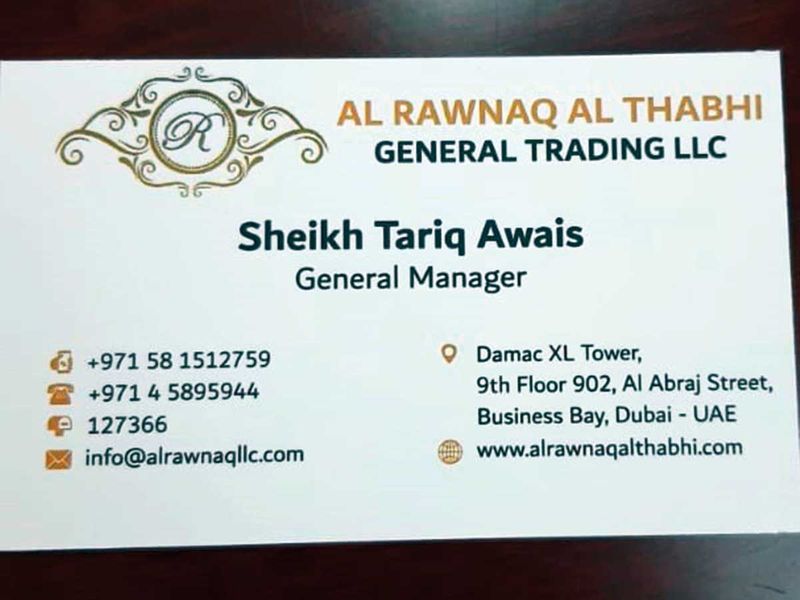

But vanish they have – not just the containers but also the owner and the entire staff of Dubai’s Al Rawnaq Al Thahbhi General Trading which ordered around 6,000 tonnes of rice from 20 odd exporters in India between March and April this year.

To give you an idea, 6,000 tonnes of rice can feed UAE’s entire population of 9.68 million for almost five days.

Meticulous Planning

The scam was carried out with such meticulous planning and attention to detail that no one suspected anything amiss.

Traders were handed a Telegraphic Transfer (TT) receipt for each shipment as ‘proof’ that their payments were being electronically remitted to their banks in India.

The money never arrived. Instead, one by one, 23 TTs totaling $4.18 million got cancelled after cheques issued against them bounced because of insufficient funds.

$ 4.14 m

is what the Indian exporters have lost to the scamBy the time panic-stricken traders rushed to Dubai, it was too late. Al Rawnaq’s rented warehouse in Al Quoz where the rice containers were delivered was empty as was the company’s office at XL Tower in Business Bay.

It’s not that the exporters didn’t do their due diligence.

“We visited Al Rawnaq Al Thahbhi’s office, checked its trade license, met its general manager and, more importantly, released the shipments only after we had received telex transfer (TT) receipts from a money exchange in Dubai confirming the acceptance of the remittance request and the initiation of the transaction,” recalls Vinod Goel of Karnal’s NM Food Impex company. He shipped 22 containers of Basmati rice worth $321,170 -- around $7,000 less than Kamla Mills’ Vipin who dispatched 17 containers.

Long list of victims

Among other rice exporters similarly duped are KG Industries ($1.02 million); Harman Rice ($553,640); Amritsar Riceland ($451,250) Aarna Foodstfuff ($289,925), AS Impex ($287,985) and Heera Rice Mills ($131,435).

Spice and coconut wholesalers have also been hit. Karnataka’s Joseph International lost $109,200, Manna Organic $125835 and Tamil Nadu’s SJN Coir Export, $210,000.

“It’s a long list and it’s getting longer with each passing day as more victims come forward. We have apprised local authorities and Indian consulate officials in Dubai of the scale of the scam. It’s obvious we are not dealing with small crooks but seasoned criminals,” said Bhupinder Singh of Harman Rice in Bhatinda, Punjab.

Pankaj Bodkhe Consul (Economic & Education) at the Indian consulate confirmed meeting some of the victims. “Yes they met us. We have taken up the matter with local authorities in Dubai,” Bodkhe told Gulf News.

Unstoppable scams

Trading scams are not new to the UAE. All of them follow the same pattern. Companies propped up by criminal syndicates using dummy owners buy anything they could lay their hands on against post-dated dud cheques. Before the cheques are banked, the owners of these companies are whisked out of the country and the ill-gotten goods sold to third parties at throwaway prices.

24,000 kg

of rice is approximately what each of the 250 shipping containers carriedThe masterminds of these scams never put their names on the trade licenses of companies they help set up. Instead they use dummy candidates. In one case, the owner of a technical firm behind a Dh10 million scam turned out to be mason. In another scam, a driver and in a third case, a cafeteria worker.

There have also been instances where criminal syndicates have taken over the management of struggling firms in return for money.

Staying in the shadows

Traders suspect this is precisely what happened at Al Rawnaq whose Indian owner, Robin Gupta left the UAE after handing the reins to a man identified as Shaikh Tariq Awais from Pakistan.

“When I came to Dubai, Tariq invited me to his sprawling six bedroom villa in Living Legends in Al Barari for dinner and sent a chauffer-driven SUV to pick me from the hotel. I was impressed. At his house, I met his wife, son and mother for whom I carried gifts. In fact, her mother lovingly put her hand on my head to bless me,” recalls Vipin Goel.

As it turns out, Tariq never owned the villa but had taken it out on rent from a real estate company for Dh20,000 monthly just weeks earlier.

“He asked for a fully-furnished villa for short term rental and paid in cash. He also took a large warehouse in Al Quoz against a post-dated cheque which has now bounced,” said the real estate agent who dealt with Tariq.

Traders said Tariq presented himself as a multi-millionaire and claimed to own a string of businesses, including a travel firm and a company called Bahar Al Foodstuff Trading against which Telex Transfer receipts were made.

“We had no reason not to believe him,” said one of them.

6,000

tonnes of rice can feed the entire population of the UAE for nearly five days.Any misgivings about the man’s credentials were dispelled when the first five payments of Dh1.5 million went through, albeit with some delays.

“There was a gap of 10-15 days between the issue of TT receipts and the transfer of funds. We found this odd as such transactions don’t take more than 2-3 working days. When we brought this to Tariq’s attention, he blamed the delay on banks. We thought this was indeed the case. Since we were eventually getting our payments anyway, we didn’t mind waiting,” said Vipin Goel.

Once Al Rawnaq had gained the trust of traders, it started placing much bigger orders.

“They made us believe that that they would re-export the rice to various countries in the GCC,” said an Indian trader who pegged his losses at $50,730.

Costly delays

Some traders are now holding the money exchange house responsible for their losses.

“If Al Rawnaq’s cheques had been submitted to banks for processing immediately, they would have bounced and their corresponding TTs got automatically cancelled. But the exchange house sat on the cheques for over several days giving the fraudsters enough time to receive the shipments on the basis of TT receipts, move the containers to their warehouse and then sell the ill-gotten goods at dirt cheap prices,” said Vipin.

The exchange house, however, denied any wrong doing.

Exchange house's response

“The issuance of a receipt (TT) neither confirms nor guarantees that the amount would be credited to the beneficiary account or received by the beneficiary. Post initiating a transaction and issuance of the receipt to the sender, the transaction can be rejected or put on hold for various reasons, either related to payment realisation, or operational issues, or compliance or regulatory concerns. This may be done by our internal compliance team, law enforcement agencies, the correspondent bank(s) or the beneficiary bank.

Specific to the cited incident, because the payment was through a cheque, the seal on the receipt clearly states that the payment is “subject to realisation of the cheque,” a spokesperson for the exchange house said in a detailed statement to Gulf News.

“Payment by any party on behalf of any other party for a transaction does not breach the regulations governing exchange houses. As an exchange House, our role and responsibility in such transactions is to ensure that all records containing the relevant details of senders and source of funds are maintained properly,” the spokesperson explained.

23

is the number of TTs that were cancelled after cheques issued against them bounced because of insufficient funds.“In this specific case, it may be noted that Al Rawnaq AlThahbi General Trading LLC and Bahar Al Hoor Foodstuff Trading LLC are group companies with the same shareholders, duly verified as per our records. When a customer approaches our branch for processing a transaction, they submit the payment (cash or cheque) and supporting documents, and thereafter will receive the receipt confirming the acceptance of the remittance request and initiation of the transaction. At this stage, TTs are not issued to the customer. Even if the payment mode is through a cheque, the customer is issued a receipt, but the transaction remains on hold until such time the cheque is cleared from the relevant bank(s) and the corresponding amount is credited to our bank account,” he said.

“For cheque payments, the receipts are issued with a seal affixed, which clearly states that payment is “subject to realization of the cheque.

Typically, cheques are submitted to the respective banks for processing within 2 working days of its receipt from the customer. However, the clearance of the cheques by the banks may take time, which varies from bank to bank. Also, at times, the customer may ask us to hold the cheque till they confirm their financial position with the bank,” the spokesperson added.

Shattered

But the traders are far from convinced.

‘I am ruined and will have to sell my house and factory. I built this business over 20 years. An oversight destroyed it overnight,” said a trader who did not wish to be named.

Also caught in the web of deceit is Dubai-based travel firm Blue Voyage which sold plane tickets and arranged visit visas for Al Rawnaq. It’s believed that the men who came on these visas struck deals with companies posing as purchase officers.

”Their cheque has bounced and two of the men have overstayed their visas resulting in Dh11,000 fines against us,” said Peter Simon, owner of Blue Voyage.

DED’s response

In response to a Gulf News query to the Department of Economic Development (DED), Mohammad Rashid Lootah, CEO of Commercial Compliance & Consumer Protection (CCCP) sector at DED said: “The Department of Economic Development cannot discuss cases under our investigation as we protect the privacy of the parties involved. The Business Protection section in the Department of Economic Development is responsible for receiving complaints relating to disputes between traders inside and outside the UAE and resolving them amicably. The section intervenes only when the complainant is a commercial entity registered within Dubai and the dispute is purely commercial. Disputes that are already resolved, or under consideration, by other competent judicial, legal or administrative entities cannot be submitted to DED.”

A rice mill owner who has flown to Dubai for the third time in the past month said he’s undecided if he should approach the court as he’s daunted by steep legal cost. Apart from lawyer’s fees we have to also fork out court fee, capped at Dh40,000. It’s like putting good money on bad money. Also, who shall I file the case against as the people behind the scam have vanished without leaving so much as a fingerprint,” he reasoned.

“It would take us years to recover our losses,” rued another trader, Vikas Bansal of Aarna Foodstuff in Chattisgarh.

Victims speak out

“When I came to Dubai, Tariq invited me to his sprawling six bedroom villa in Living Legends in Al Barari for dinner and sent a chauffer-driven SUV to pick me from the hotel. I was impressed. At his house, I met his wife, son and mother for whom I carried gifts. In fact, her mother lovingly put her hand on my head to bless me.

Vipin Goel, managing director, Kamla Rice & General Mills, Karnal Haryana

“The list of victims is long list and it’s getting longer with each passing day as more victims come forward.”

Bhupinder Singh, owner, Harman Rice, Bhatinda, Punjab.

Modus operandi

- Conmen open new company or take over management of struggling firms in return for money

- Armed with a trading licence, these companies then approach UAE/overseas firms for business enquiries. The first contact is usually made by a purchase or procurement manager.

- Passports, visas and Emirates ID of the company’s owner/partner and sponsor are produced along with fudged audit reports

- The next step of this well-planned drill involves purchasing of goods for cash to gain trust.

- Days later, bulk orders are placed for the same goods against post-dated cheques

- Before the cheques can be presented, the goods are sold from warehouses at dirt cheap prices.

- With millions in hand, the swindlers shut shop and disappeared