New Delhi: India’s parliament was adjourned for a third day as the opposition sought to draw attention to what they describe as the close ties between Prime Minister Narendra Modi and billionaire Gautam Adani ahead of national elections due next year.

Adani’s companies have witnessed a stock rout after US short seller Hindenburg Research accused the conglomerate of widespread fraud and stock market manipulation. The market value of the group has almost halved since Hindenburg’s allegations, which have been repeatedly denied by them.

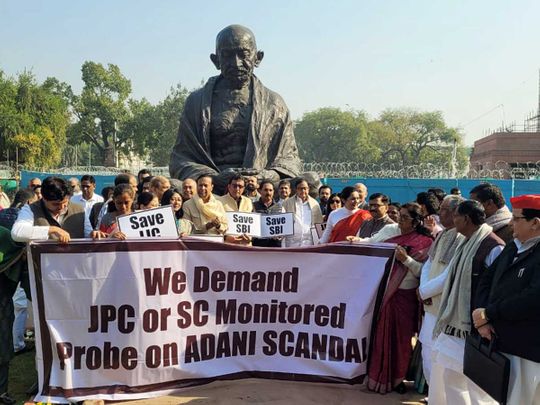

The main opposition Congress party staged protests Monday in front of the offices of the Life Insurance Corporation and State Bank of India to highlight the risks to millions of small investors due to these state-owned institution’s exposure to the tycoon’s companies. Adani and Modi are believed to be close and the billionaire has often aligned his business plans with the prime minister’s growth strategy for India.

“Amid the allegations against the Adani Group, the Modi government has maintained a loud silence which smacks of collusion,” Congress general secretary Jairam Ramesh said in a statement over the weekend.

The concerns that savings of ordinary Indians could be wiped out could carry political risk for the ruling party, looking at a third term in office. Allegations of graft or favouritism could also hurt, but only if the opposition is able to mobilise people to the streets.

The opposition, while vocal, has so far struggled to make any criticism stick. The first real test of whether these allegations can hurt the BJP’s electoral standing will come in May when a key southern state of Karnataka heads to the ballot.

Indian retail investors’ holdings in the Adani Group are small because of the low availability of equity shares, insulating them from the recent meltdown. Domestic mutual funds also have a minuscule presence in the company with LIC, the country’s insurance behemoth and the largest holder among domestic financial institutions, owning just over 4% of the shares. Yet LIC’s investments, worth a total of $4.5 billion in Adani Group companies, has become a lightning rod for opposition lawmakers.

Modi himself has remained silent on the matter so far. However, policy makers and regulators stepped in over the weekend to calm frayed nerves over concerns the turmoil surrounding Adani’s business empire would spill over into the local economy and affect global investor sentiment toward the country.

There are some signs the government is distancing itself from Adani and his business troubles and has started “damage control,” said political columnist Neerja Chowdhury. “Lots of issues are at stake,” she said, referring to India’s presidency of the Group of 20, state elections this year and a national ballot in 2024, and the government will “try and manage the situation that doesn’t hurt them beyond the point.”

A spokesperson of the BJP could not be immediately reached for comment.

The Congress party may on Tuesday afternoon participate in a debate over the president’s address made at the start of this budget session of parliament, said Adhir Ranjan Chowdhury, a senior party leader in the lower house of parliament. They will continue to raise the Adani issue in the house.

On Monday, a few dozen opposition lawmakers gathered outside the parliament building and demanded a joint parliamentary committee to probe the allegations against the tycoon. Both houses were adjourned for the day amid the pandemonium.

Heavy security blanketed a New Delhi protest site where the Congress was set to carry out protests. About 200 people showed up and most were members of the party’s youth wing. The demonstrators dispersed within 45 minutes.