Looking at possible avenues of investing one’s savings has been a never-ending search and more often than not the solution has often turned out to be popular assets such as cash, stocks or bonds.

Looking at possible avenues of investing one’s savings has been a never-ending search!

Over the last couple of decades other modes of investments have turned increasingly traditional as well – some of them being mutual funds, real estate investment trusts and exchange-traded funds.

Commonly referred to as traditional investments, these have stood the test of time and have historically proven themselves to be means of stable income and mediocre returns.

But gone are the days where the only way you could invest was through such traditional means.

Alternative investments broadly comprises of putting your money in cryptocurrency, venture capital, private equity, hedge funds, commodities, derivatives, currencies, structured notes, futures, and more.

Investments in real assets such as precious metals, antique coins, fine beverages, stamps and highly-rare art or paintings are other increasingly popular means of popular investments.

Do investments in fine art and antiques work as an alternative investment?

Art and antiques are extremely vulnerable to fluctuations in public tastes and other factors, so they are considered high-risk, speculative investments.

Most authorities agree that you should buy art and antiques primarily because you like them, and only secondarily because they may return a profit.

-

In contrast, traditional investing takes place over a longer time span at a more moderate level of risk. Moreover, transportation, marketing and selling such alternatives can prove costly and time consuming.

While some people would argue that alternative investments are the only way to go nowadays, there are others who believe traditional investments are still the best.

Like other alternative investments, art and antiques are not a ‘liquid’ investment, meaning they generally cannot be resold quickly for a profit.

One reason is that the market for these items fluctuates. If you need to sell your items quickly and the market is down, you could lose money.

If you paid retail price initially, you may sell at a wholesale price or lower when selling for urgent cash. So, such investments have increasingly become an investment choice for those who have money to lose.

To make a profit, you need to keep your items until their value increases enough to make up the difference. In the art and antiques markets, this usually is a very long time.

So, is investing in art, antiques, stamps or coins worth your money?

Even though they are not useful in making a quick buck or profit and not worth all your money, they are still effective investments and are widely used as means to diversify one’s portfolio and balance out risks.

The market for antiques and fine art is extremely competitive and the reality remains that they are always in demand. It has been widely seen that such investments have even quadrupled in value over time.

Although not useful in making a quick buck or profit and not worth all your money, they are still effective investments

In addition to the investments being aesthetically pleasing and a much-popular tool for interior decorators, art and antiques have proven themselves to be utilitarian investments.

In this regard, art and antiques have an immediate and practical advantage over other types of investments.

Often they are fragile, requiring proper environmental conditions, regular maintenance, adequate insurance and security, and frequent appraisals.

Avoid putting more than 10 to 15 percent of the value of your investment portfolio into art and antiques, or any other alternative investments.

They often have higher fees associated with them, and they're more unpredictable than traditional investments such as stocks, bonds, and mutual funds.

Usually, institutional investors or accredited investors with a high net worth hold alternative investments because of their complexities, level of risk and deficiency of regulation.

And often, only those deemed as accredited investors have access to alternative investment offerings. (Accredited investors are those with a with a personal income of at least $200,000 (Dh734,590).)

These investments have grown in popularity because institutional investors, which include pension and endowment funds, are increasing their investments in alternative options.

These investments have grown popular as institutional investors are increasing their investments in alternative options.

And with growing popularity, they are also making their way into the portfolios of retail (individual) investors as well. There can be availed by non-accredited investors through mutual funds and ETFs.

Let’s break this down further.

But with growing popularity, they are also making their way into the portfolios of retail (individual) investors as well!

How individual or small investors too can get a ‘piece of the action’!

Alternative investments were at one point only available to the ‘elite’ or sophisticated investors like institutions, such as pension funds and foundations, and the wealthy.

But retail investors now have access to more financial information, investment education, and trading tools than ever before.

Brokerage fees have fallen, and mobile trading is enabling investors to actively manage their portfolios from their smartphones or other mobile devices.

A huge range of retail funds and brokers have modest minimum investment amounts or minimum deposits of a few hundred dollars, and some ETFs and robo-advisors don’t require any.

Alternative investments are now feasible to retail investors via alt funds, ETFs and mutual funds!

So, alternative investments have now become feasible to retail investors via alt funds, which are nothing but ETFs and mutual funds that build portfolios of alternative assets.

Since most alternative investments are costly and difficult to invest in, these funds provide access to alternative investment categories for average investors.

As the name suggests they are nothing but publicly offered mutual funds that hold non-traditional investments or use complex investment and trading strategies.

It is repeatedly advised that investors considering alt funds should be aware of their unique characteristics and risks.

Here are some of the broadest categories of the most common alternative investments:

• Hedge Funds: These funds can invest in a wide range of securities and are generally limited to publicly traded investments.

There are many different types of strategies, but usually the goal is to use their specific strategy to generate returns in both up and down markets.

Hedge funds use a specific strategy to generate returns in both up and down markets!

• Venture Capital: These firms focus on investing equity into privately-owned companies.

Generally, these companies are at an early-stage or start up level with the goal is to grow rapidly and eventually seek an exit either by acquisition of another company or by an Initial Public Offering (IPO).

The more online retailers, exchanges and brick and mortar stores accept cryptocurrency as payment, the more valuable and liquid cryptocurrency will become.

And because of which, the more attractive it will be compared to other relatively illiquid alternative investments.

• Private Equity: A private equity investment is a type of alternative investment. Individuals own a portion of a company that is not publicly owned, quoted or traded on a stock exchange.

How do they work? Private equity investment strategies include company buyouts and contributing venture capital. The types of assets they invest in extend from real estate, to infrastructure, to oil & gas, to debt.

• Fund of funds: A fund of funds (FOF) is a pooled investment fund that invests in other types of funds.

Fund managers in the PE class can range from smaller million-dollar funds to multiple billions

In other words, its portfolio contains different underlying portfolios of other funds. But certain structural issues have caused fund-of-funds to become less and less popular.

But the majority of investors will benefit more greatly from private equity alternatives, especially as that is where the greatest gap lies for most investors.

Let’s first explore the perks of choosing alternative investments!

What it means by less co-relation is that stocks don’t move in tandem with markets and aren’t prone to shocks or market-induced vulnerability.

• Potential for higher return

As such investments are not vulnerable to potential losses on the stock market, there potential for the rate of return on such alternative investments to be higher than that of traditional investments.

But like any investment, the rate of return for alternatives is not guaranteed and again, as with any investment, the potential for a higher return also means higher risk.

Potential for the rate of return on such alternative investments to be higher than that of traditional investments!

Higher risk in this case mostly refers to how alternative investments – though not seen vulnerable to stock market shocks, are increasingly seen as highly unpredictable.

By being unpredictable it means you could make or lose a lot of money very quickly, which is the reason why there are still many people who still stay away from alternative investments.

• Direct ownership

If you have bought a rental property, you directly own the home. If you buy a mortgage note, you have a lien against a property. In most other investments, what you’re buying is a paper asset.

(What are mortgage notes? They are essentially a written promise to repay a specified sum of money plus interest at a specified rate and length of time to fulfill the promise.)

Even if you invest in a REIT, you’re many levels removed from having your name on the deed of the real estate property.

If you have bought a rental property, you directly own the home. In most other investments, what you’re buying is a paper asset.

• Direct tax benefits

Alternative investments can also provide compelling tax benefits. With many alternative investments you get to keep more of your profit because of the structure.

In many private alternative investments, you become a part-owner of the fund and as such the tax benefits get directly passed on to you.

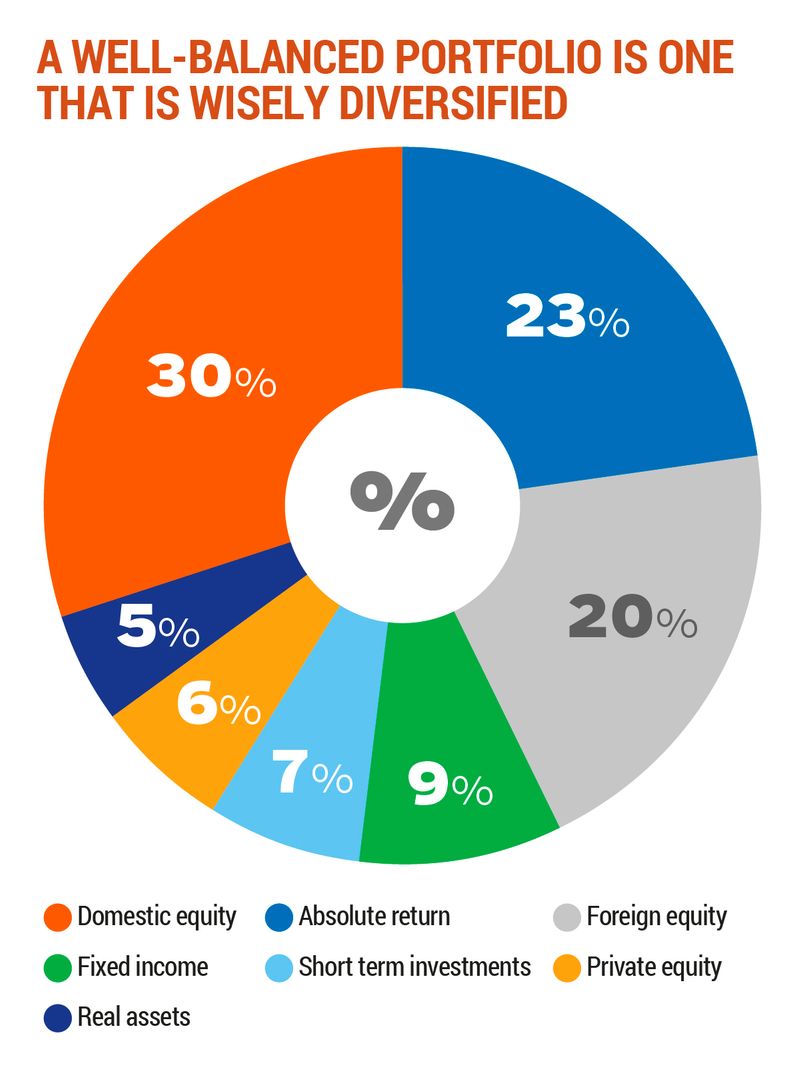

Portfolio diversification can be defined as having a varied assortment of investments in order to avoid the possibility of having only one or a few that underperform.

Alternative investments are an important factor in portfolio diversification because they provide a range of other options.

Let’s now look at some of the key drawbacks when it comes to investing in alternative investments by comparing it against traditional investments.

• Issue of liquidity

Assets put into traditional investments tend to be easily accessible at any time, by the investor.

One of the key differences between traditional and alternative investments is the liquidity. Assets put into traditional investments tend to be easily accessible at any time, by the investor.

For instance, it is more of a challenge to sell a piece of art than 100 shares of Facebook. Or if you were to purchase a house, for example, that house would need to be sold before you could access the funds.

• Lack of support

Although you may find quite a bit of research when it comes to learning about traditional investments for the first time, because trading strategies differ with each individual, investors tend to keep those a secret.

There are some distinct differences about the kind of support you’ll find for each investment option.

You may then be forced to use a financial advisor, but they could cost more than you’re willing to invest. Trying to navigate the stock market can seem almost difficult, especially at first.

There is less research into alternative investments compared to conventional ones, so you often have to rely largely on information from an unbiased investment provider – which again, comes at a price.

If you don’t have a lot of money to invest, then decent-sized returns will take twice as long returns. Traditional investments require smaller minimums, but also have a lower return on investment.

Regulation of alternative investments

Even when they don't involve unique items like coins or art, alternative investments are prone to investment scams and fraud due to their unregulated nature.

Alternative investments are often subject to a less clear legal structure than conventional investments.

Alternative investments are often subject to a less clear legal structure than conventional investments. They are not regulated by the regulatory bodies as are mutual funds and ETFs.

So, it is essential that investors conduct extensive due diligence when considering alternative investments.

During the 2008 financial crisis, alternative investment options held their own, predominately. Traditional investments didn’t do so well.

Key takeaways?

• Alternative investments may be illiquid – that means it might be hard to sell the investments quickly if you need the cash

• The value of an alternative investment, such as a stamp or a piece of land in a foreign country, can be very difficult for you to assess.

In contrast, shares and bonds are traded on open, transparent markets and you can always see the price

• Sometimes alternative investment opportunities can provide a cover for scams – people trying to con you out of your money. This is much less common with assets like shares and bonds.

• Alternative investments are likely to perform very differently from the stock market or other investments like bonds.

• The minimum investment required to get involved in many alternative investment schemes can be quite high (a five-figure sum in a lot of cases; For example: hedge funds)

Conclusion

For the most part, alternative investments appeal to serious and accredited investors. They often require a lot of money upfront and can carry substantial risks.

For the most part, alternative investments appeal to serious and accredited investors.

Alternative investments don’t always pay off, but when they’re successful they can generate large returns much faster than publicly traded stocks. (This is why some investors win big, some lose big.)

If you don’t have the capital to invest in alternative investments directly, you may want to consider alternative mutual funds or ETFs.

Perhaps the sensible way forward is to diversify your trading portfolio; a little bit of both traditional and alternative.

Even if an alternative investment opportunity is perfectly legitimate, it doesn’t mean that it will without doubt be a suitable investment for you. It highly depends on how much risk you are willing to take on.

The risk you are willing to take on will depend on your investment horizon (term or time period of investment) and your investment target or what you are trying to achieve by investing.

The question that you need to ask yourself is - will the chosen alternative investment meet your goals?

The reason being small companies tend to reinvest all their profits back into the business rather than paying out dividends to shareholders.

Because of the risks attached to alternative investments, you should only invest money you can afford to lose.

Unless you are an expert on whatever ‘alternative’ you are investing in, it’s advisable to keep most of your money in conventional assets (shares, bonds and so on).

Because of the risks attached to alternative investments, you should only invest money you can afford to lose.