Stock prices rise and fall, with investor sentiment. That’s normal in any market. But deliberate stock price manipulation is an entirely different banana altogether. It often involves fraud, insider trading, pump-and-dump schemes, or outright rigging.

They undermine markets. They pose serious consequences for investors as well as regulators. From the infamous Madoff and Enron scandals to the Bre-X and Theranos scam, these cases serve as cautionary tales for investors and regulators alike.

The spotlight eventually exposes such Ponzi schemes, which are sometimes backed by accounting fraud.

After investors suffer immense financial losses, victims of such crimes are unlikely to get most of the money back. Legal consequences and criminal charges often follow.

Buckle up for an exploration of these infamous scams and their far-reaching impacts. Most notorious stock fraud cases and the estimated losses:

1. Madoff: $65 billion

Bernard Lawrence "Bernie" Madoff was an American financier who executed the largest Ponzi scheme in history, defrauding thousands of investors out of an estimated $65 billion over the course of at least 17 years. Madoff Investment Securities LLC promised investors consistently high returns. The scheme collapsed in 2008.

- Person(s) involved: Bernard Madoff

- Location: United States

- Penalty: Imprisonment for Madoff (150 years)

- Madoff orchestrated the largest Ponzi scheme in history, defrauding investors of billions of dollars.

Enron: $60 billion

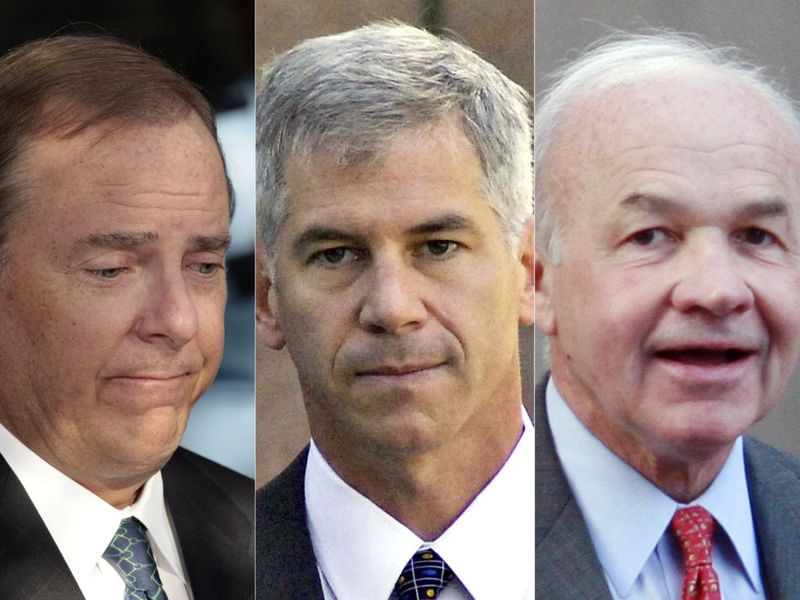

Enron Corp, once a powerhouse in the energy industry, became infamous for its massive accounting fraud that led to its bankruptcy in 2001. Estimates suggest that the total cost of the scandal exceeded $60 billion. Through a complex web of deceptive practices, Enron executives inflated the company's profits and hid its mounting debt, misleading investors and creditors. Many executives were convicted and sentenced to prison.

- Person(s) involved: Kenneth Lay, Jeffrey Skilling, Andrew Fastow

- Location: United States

- Penalty: Bankruptcy, imprisonment for key executives

- Enron, an energy trading company, used complex financial schemes to inflate its stock price. This led to the collapse of the company and significant losses for investors.

Parmalat: $18.6 billion

The Italian food conglomerate Parmalat was involved in a massive accounting fraud, hiding billions of euros in debt. The scandal involved a massive scheme that had been going on for years, involving fake accounting, embezzlement, and false statements to regulators.

Several executives were arrested and convicted. Reuters reported losses amounting to 14 billion euros ($18.6 billion) from this debacle.

- Persons involved: Calisto Tanzi

- Location: Italy

- Penalty: Bankruptcy, imprisonment for Tanzi

- Parmalat, an Italian food and beverage company, used complex financial schemes to hide its debt and inflate its stock price.

The Association of Certified Fraud Examiners (ACFE), defines fraud as “a deception or misrepresentation that an individual or entity makes knowing that misrepresentation could result in some unauthorised benefit to the individual or to the entity or some other party”.

Why is accounting fraud bad?

• Accounting fraud can lead to significant financial losses for investors who rely on accurate financial information to make informed decisions. When companies engage in fraudulent accounting practices, it can erode investor confidence and destabilize the financial markets.

• It is illegal and can result in severe penalties, including fines, imprisonment, and damage to a company's reputation. Fraud undermines public trust in businesses and financial institutions, making it difficult for companies to operate effectively.

WorldCom: $11 billion

WorldCom's executives inflated the company's revenue by improperly classifying expenses as capital expenditures. This led to a massive accounting fraud that resulted in bankruptcy and criminal charges.

The total amount of fraud was estimated to be around $11 billion. Several top executives at WorldCom were convicted of fraud and sentenced to prison.

- Persons involved: Bernard Ebbers

- Location: United States

- Penalty: Bankruptcy, imprisonment for CEO Bernard Ebbers (Some of the most notable names include its CEO Bernie Ebbers, CFO Scott Sullivan, and the company's auditing firm, Arthur Andersen. Wall Street analyst Jack Grubman also played a role in providing the telecom company with positive ratings.

- The telecommunications giant was found to have inflated its profits by billions through accounting fraud. This led to the company's collapse and massive investor losses.

Theranos: $10 billion

Elizabeth Holmes, founder of Theranos, was accused of defrauding investors by making false claims about the company's blood-testing technology. At its peak (in 2013 and 2014), the company had a market valuation of $10 billion.

US media reported that investors in Theranos included Walmart's founding Walton family ($150 million), media mogul Rupert Murdoch (about $120 million), former US Secretary of Education Betsy DeVos ($100 million), Henry Kissinger ($3 million). Holmes was convicted of wire fraud and sentenced to 11 years in prison.

- Persons involved: Elizabeth Holmes

- Location: United States

- Penalty: Imprisonment for Holmes

- Theranos, a healthcare technology company, claimed to revolutionise blood testing but was found to have inflated its technology's capabilities and misled investors.

Bre-X Minerals: $6 billion

In 1993, Bre-X geologist Michael de Guzman claimed a massive gold discovery in Indonesia. This sparked a frenzy, driving stock prices sky-high. However, de Guzman's mysterious death and subsequent investigations revealed the discovery was a hoax.

The scandal caused Bre-X's collapse and numerous lawsuits, but no one has been held accountable. In 2005, there were reports that de Guzman was alive, but nothing came out of it.

- Persons involved: Michael de Guzman

- Location: Canada, Philippines

- Penalty: Death of de Guzman (suspected suicide)

- Bre-X Minerals, a Canadian mining company, falsely claimed to have discovered a massive gold deposit in the Philippines. The stock price soared, then collapsed when the fraud was exposed.

Wirecard: $4 billion

The Wirecard scandal was a series of corrupt business practices and fraudulent financial reporting that led to the insolvency of Wirecard, a payment processor and financial services provider, headquartered in Munich. The German payments firm filed for insolvency in 2020 after disclosing a €1.9 billion ($2.1 billion) hole in its accounts.

Its former boss, Markus Braun, went on trial accused of involvement in the biggest fraud case in German history. On June 25, 2020, Wirecard filed for insolvency, owing creditors almost $4 billion after disclosing a gaping hole in its books, Reuters reported.

- Persons involved: Markus Braun

- Location: Germany

- Penalty: Bankruptcy, arrest of Braun

- Wirecard, a German payments company, overstated its assets and revenue, leading to a massive accounting scandal and the company's collapse.

Satyam Computer Services: $2.82 billion

It was a huge corporate fraud committed in 2009 by Ramalinga Raju, the founder and chairman of Satyam Computer Services. He admitted to exaggerating sales, earnings, cash balances, and personnel numbers in the company's books.

Raju also acknowledged siphoning off money from the firm for his personal use. Scientific Research Open Access (SCIRP) estimates that investors lost up $2.82 billion in this scam.

- Persons involved: Ramalinga Raju

- Location: India

- Penalty: Imprisonment for Raju

- Satyam, an Indian IT services company, inflated its revenue and profits through fraudulent accounting practices.

HealthSouth (2003): $2.5 billion

HealthSouth was involved in accounting fraud, with earnings overstated by anywhere from $3.8 billion to $4.6 billion over several years. This false information drove inflated market values for the firm, which attracted more capital investment.

That capital came from individual investors as well as institutional money. Investigators found that since 1999 the company systematically overstated its earnings by at least $1.4 billion in order to meet or exceed Wall Street earnings expectations. The false increases in earnings were matched by false increases in its assets.

In 2007, HealthSouth official Richard Scrushy was sentenced to nearly seven years in prison for bribery. While serving his sentence in a Texas prison, a civil court found him liable for the HealthSouth accounting fraud. After serving about five years of his sentence, Scrushy was released from prison.

- Persons involved: Richard Scrushy

- Location: United States

- Penalty: Imprisonment for Scrushy

- HealthSouth, a healthcare company, overstated its earnings by billions through fraudulent accounting practices.

Tyco International (2002): $2 billion

Tyco's executives were accused of looting the company through fraudulent expense reimbursements and unauthorised loans. Tyco's stock plunged from $60 per share in January 2002 to $18 per share in December 2002. Many of the firm's 260,000 employees were also shareholders and watched their savings go up in smoke.

Several executives were convicted and sentenced to prison. Richard Scalzo, the PriceWaterhouse auditor who signed off on Tyco's 2002 audit, was fired.

- Persons involved: Dennis Kozlowski, Mark Swartz

- Location: United States

- Penalty: Imprisonment for Kozlowski and Swartz

- Tyco, a conglomerate, engaged in accounting fraud, looting company funds, and inflating stock prices through misleading financial statements.