(This information is for general knowledge only. It's not financial advice. Always consult a professional financial advisor for personalised guidance.)

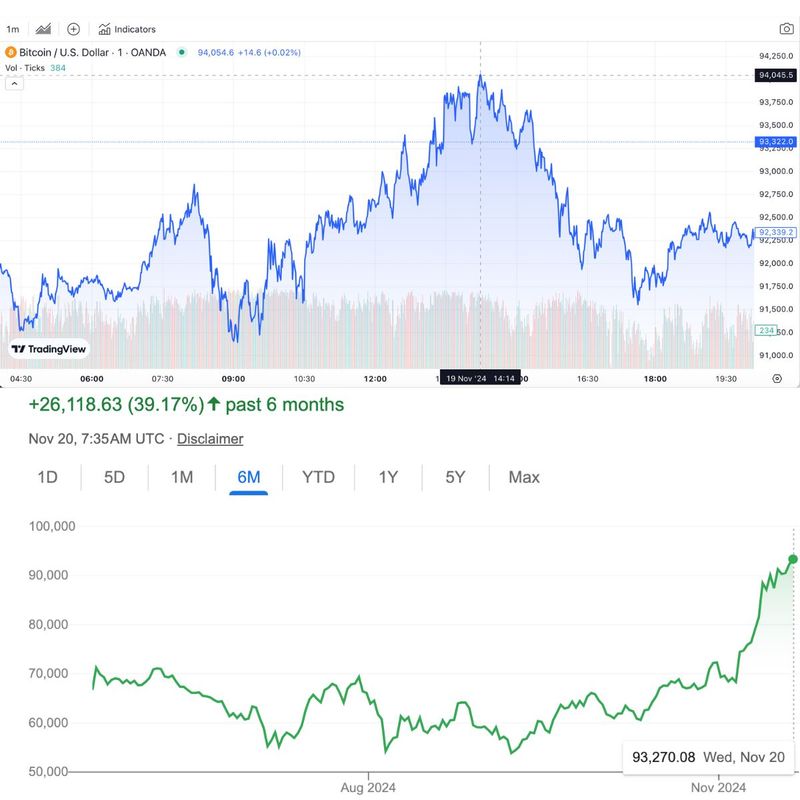

Clearer crypto regulations, greater institutional adoption and rising global economic uncertainty have all conspired to take Bitcoin price (BTC) to the moon – the crypto stood at $92,799 on Wednesday November 20 (7:35 am UTC), down slightly after reaching an all-time high on Tuesday (November 19), at $94,053.9.

It's been up nearly 40 per cent in the last six months. The recent jump, however, has been attributed in part to the election of Donald Trump as US President, which has positively influenced the cryptocurrency market.

Within hours of Trump’s projected re-election victory, Bitcoin spiked by 7.23 per cent, reaching an all-time high of $75,358.

Following are the key factors behind Bitcoin’s recent price rally:

1. “Trump effect”

Donald Trump’s election victory has been perceived as favourable for cryptocurrencies in general, leading to increased investor confidence and demand for digital assets.

Additionally, Trump’s appointment of Elon Musk as head of the Department of Government Efficiency has further boosted market optimism, particularly benefiting cryptocurrencies such as Dogecoin.

Chicago-based financial services company CME Group (which founded of the oldest exchange, Nasdaq, in 1848) highlighted the potential impact of a "crypto-friendly" administration on Bitcoin's price. It also mentioned the role of Bitcoin "futures" in managing risk and facilitating institutional investment.

These developments have contributed to Bitcoin reaching new all-time highs, reflecting the market's response to the anticipated crypto-friendly policies of the incoming administration.

2. Institutional adoption

Major financial institutions like BlackRock and Fidelity are launching Bitcoin ETFs, signalling mainstream acceptance. This influx of institutional investment is driving demand and pushing prices upward.

FXStreet, a forex news site, has highlighted the growing trend of companies adopting Bitcoin as a "reserve" asset. They cite examples of companies like MicroStrategy and Tesla increasing their Bitcoin holdings, which has contributed to a rise in investor interest and price spike. "Bitcoin could see another parabolic run following rising institutional interest," FXStreet wrote.

Meanwhile, crypto hedge funds are enjoying a dream run, thanks to surging digital asset prices and institutional interest. This rise aligns with broader trends of Bitcoin gaining traction as a hedge during periods of economic and political uncertainty.

3. Scarcity and the “halving” effect

Bitcoin's scarcity effect refers to the limited supply of Bitcoin, which is capped at 21 million coins. This makes it inherently "deflationary".

With the next halving event, block rewards will drop, reducing new Bitcoin supply and increasing its scarcity-driven value. The exact time of the halving is determined by the network "hashrate".

After the halving, the rate of issuance of new Bitcoin as well as the rewards for successful Bitcoin miners are cut in half. There can only be 21 million Bitcoin, and fewer new tokens entering circulation could impact its price.

• Fixed Supply: The Bitcoin protocol is designed to limit the total number of coins to 21 million.

• Halving events: Approximately every four years, the number of Bitcoins rewarded to miners is halved. This reduces the rate at which new Bitcoins are added to the supply.

• Increasing Demand: As more people and institutions recognise the value of Bitcoin, demand for it increases, further driving up its price.

While scarcity can contribute to price appreciation, it's not the sole determinant of Bitcoin's value. Other factors, such as technological advancements, regulatory changes, and market sentiment, also play significant roles.

(Source: Bookings)

4. Regulatory clarity in key markets

Countries like the US and EU are implementing clearer crypto regulations, boosting investor confidence. This legal clarity makes Bitcoin a safer and more attractive option for institutional and retail investors alike.

Another key factor: a positive shift in Bitcoin’s Coinbase premium index, which signals growing retail demand in the US, and heightened trading volumes on major exchanges like Binance and Bitfinex.

5. Technological innovations and network growth:

The Lightning Network and other scalability upgrades are making Bitcoin faster – and cheaper – to use. Coupled with growing global adoption and improved security, this boosts its utility and long-term appeal.

Among technical analysts, traders have also highlighted a bullish “cup-and-handle” pattern in Bitcoin's chart, projecting a potential price target of $110,000 if the current momentum continues.

There are also fears of geopolitical instability, and banking crises, which have prompted investors to flock to Bitcoin as a “digital gold” hedge against traditional financial systems.

Will this rally be sustained? It all depends on market conditions, regulatory oversight and global events.

Important note: Bitcoin is a highly volatile asset, and its price can fluctuate significantly. While the factors mentioned above have contributed to the recent rally, it's essential to consider the risks associated with investing in cryptocurrencies in general.